This post comes to you from: Mortgage Broker Adelaide - Home Loans Adelaide - Urbantech Finance

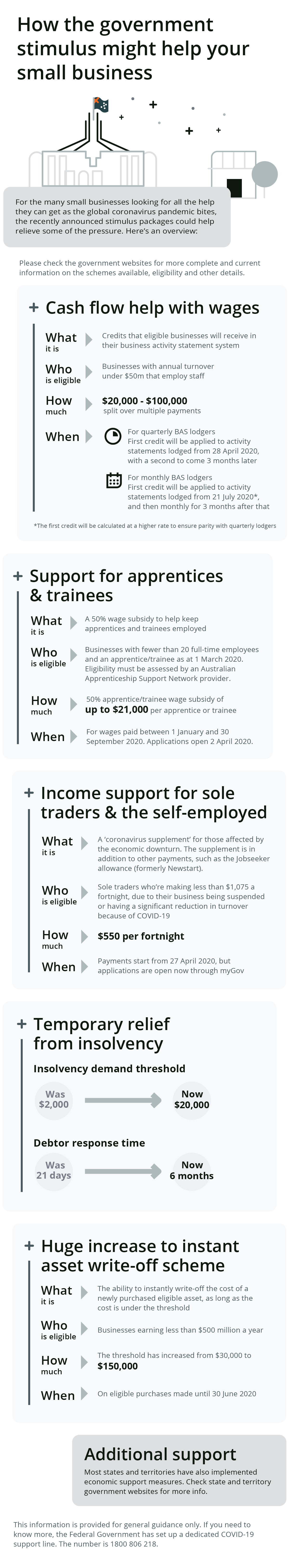

In response to the economic impact of the coronavirus, the Australian Government has introduced a number of stimulus packages to assist small and medium businesses.

The measures include cash flow boosts of up to $100,000 for businesses with employees, wage subsidies for apprentices and trainees as well as the recently announced JobKeeper program.

A suite of tax changes is also aimed at driving business investment, by offering instant tax write-offs for asset purchases, as well as other measures.

Here’s what you need to know;

How do the cash flow boosts work?

The cash flow boost will be automatically given to business through their business activity statements.

The cash flow boosts will work by giving businesses a tax credit equal to how much tax they withhold [to the ATO in their activity statements] on their staff salary and wages, up to a cap of $50,000 in total, with additional payments for businesses still trading to be made through to September 2020, up to another cap of $50,000.

It’s complex, but here’s an example of how it could work:

Say Tim runs a salon with 12 hairdressers on staff, each with an average annual salary of $50,000. He withholds $8,788 in each of his monthly BASs. Under the scheme, Tim would receive a credit of $26,634 for the March period, followed by credits of $8,788 each for April and May, before receiving a final credit of $6,060 for June, when he would reach the cap of $50,000. If he keeps the same headcount, he would also receive additional monthly payments totaling up to $50,000 through until September.

Businesses that don’t withhold any tax for employees will still be eligible for payments amounting to a minimum of $10,000.

JobKeeper Program [*New Announcement]

The recently announced $130 billion JobKeeper program has left many small to medium businesses with questions regarding eligibility and how it will be implemented. Here’s what you need to know.

The JobKeeper payment is intended to provide wage subsidies to businesses that are significantly affected by COVID-19.

Am I eligible for the coronavirus wage subsidy?

Employers will be eligible for the subsidy if:

- their business has a turnover of less than $1 billion and their turnover will be reduced by more than 30 per cent relative to a comparable period a year ago;

- their business has a turnover greater than $1 billion and a turnover drop of 50 per cent or more;

- their business is not subject to the Major Bank Levy;

- the employer must have been in an employment relationship with eligible employees as at 1 March 2020;

- not-for-profit entities (including charities) and self-employed individuals that meet the turnover tests that apply for businesses are also eligible to apply.

What is an eligible employee?

Eligible employees are employees who:

- are currently employed by the eligible employer;

- were employed by the employer at 1 March 2020;

- are full-time, part-time or long-term casuals, a casual employed on a regular basis for longer than 12 months as at 1 March 2020;

- are at least 16 years of age;

- are an Australian citizen, the holder of a permanent visa, a Protected Special Category Visa Holder, a non-protected Special Category Visa Holder who has been residing continually in Australia for 10 years or more, or a Special Category (Subclass 444) Visa Holder;

- are not in receipt of a JobKeeper payment from another employer.

What do I need to do to register?

Business owners need to:

- register an intention to apply on the ATO website;

- provide information to the ATO on eligible employees;

- provide monthly updates to the ATO;

- notify all eligible employees they will receive the payment.

What if I am a sole trader?

Sole traders need to:

- register their interest with the ATO;

- provide an ABN for their business;

- nominate an individual to receive the payment;

- provide the nominees’ Tax File Number;

- provide a declaration as to recent business activity;

- provide a monthly update to the ATO to declare their continued eligibility for the payments.

How will the ATO check eligibility?

The ATO will use the Single Touch Payroll to administer the funds, requiring businesses to keep the employees employed in order to be eligible for the payment.

How will it be paid?

Eligible employers will be paid $1,500 per fortnight per eligible employee.

Eligible employees will receive, at a minimum, $1,500 per fortnight, before tax, and employers are able to top up the payment.

Payments will be made to the employer monthly in arrears by the ATO.

When will the cash start flowing?

While the program commenced on Monday, businesses will not receive cash until the first week of May.

The ATO will reimburse companies for missed payments — for the last two days of March and the whole of April.

What about superannuation?

Employers are expected to continue to pay the superannuation guarantee on regular wages.

However, it will be up to the employer if they want to pay superannuation on any additional wage paid because of the JobKeeper payment.

How long will the scheme last?

The scheme will last six months.

Example provided by the government

Adam owns a real estate business with two employees. The business is still operating at this stage, but Adam expects that turnover will decline by more than 30 per cent in the coming months. The employees are:

- Anne, who is a permanent full-time employee on a salary of $3,000 per fortnight before tax and who continues working for the business; and

- Nick, who is a permanent part-time employee on a salary of $1,000 per fortnight before tax and who continues working for the business.

Adam is eligible to receive the JobKeeper payment for each employee, which would have the following benefits for the business and its employees:

- The business continues to pay Anne her full-time salary of $3,000 per fortnight before tax, and the business will receive $1,500 per fortnight from the JobKeeper payment to subsidise the cost of Anne’s salary and will continue paying the superannuation guarantee on Anne’s income.

- The business continues to pay Nick his $1,000 per fortnight before tax salary and an additional $500 per fortnight before tax, totalling $1,500 per fortnight before tax. The business receives $1,500 per fortnight before tax from the JobKeeper payment which will subsidise the cost of Nick’s salary. The business must continue to pay the superannuation guarantee on the $1,000 per fortnight of wages that Nick is earning. The business has the option of choosing to pay superannuation on the additional $500 (before tax) paid to Nick under the JobKeeper payment.

Adam can register his initial interest in the scheme from 30 March 2020, followed subsequently by an application to ATO with details about his eligible employees. In addition, Adam is required to advise his employees that he has nominated them as eligible employees to receive the payment. Adam will provide information to the ATO on a monthly basis and receive the payment monthly in arrears.

Who can you turn to for answers?

The impact of the coronavirus has made it really tough for small businesses.

If you have questions, the best person to talk to would be your Accountant and Finance Broker, otherwise, you can contact the ATO directly on their new COVID-19 support line 1800 806 218 and they will assist you.

Need quick funds for your business?

Unsecured Business Loans

The good news is we offer small business loans that could help your business grow and thrive during these difficult times.

All you need is an ABN and 6 months in business to apply for a loan. Best of all you don’t need to provide financials or any security for loan amounts less than $150,000.

The amount you can borrow is based on the turnover [gross income/revenue] of your business, which is verified by your last 3 months of business bank statements.

As a general rule you can expect to borrow 100% of your monthly business turnover – for example, if you have $50,000 in monthly revenue you will qualify for a $50,000 business loan.

>> GET STARTED – For more details and to apply visit xpressbusinessloans.com.au

Does your business qualify?

If your business has a turnover of more than $5,000 per month and can demonstrate at least 6 months of trading for a new business, or at least 3 months if you’ve purchased an existing business, we can help.

What you need;

– An active ABN [been in business 6 months]

– 3 months of business bank statements

– Minimum $5,000 in monthly turnover/revenue

Loan Features;

– Borrow $5,000 – $300,000

– Loan rates from .75% per month

– 100% Unsecured – No collateral required!

– Low Doc – No financials required!

– 3 to 36 month loan terms

– Cash flow friendly repayments [daily, weekly or fortnightly]

– Approved and funded in as little as 24 hours!

– No hidden fees

– No interest penalty for early repayment

>> GET STARTED – To apply visit xpressbusinessloans.com.au/apply

For more details feel free to call 08 8451 1500 or email us with your query.

Cheers,

Sam, Matt & Andy

Urbantech Finance

PS. We understand many people in the community are self-isolating, quarantined or practising social distancing. I’d like to reassure you that you do not need to leave your home to get financial help. Please reach out to us and we can find a solution that works for you, whether that be via email, phone or a video app.

PPS. Just a final note, it’s not all doom and gloom – in fact, in times of financial uncertainty new opportunities can present themselves whether you’re a property investor, developer or small business owner. Keep a positive mindset, make smart financial decisions and keep an eye out for any opportunities – who knows, rather than just survive, you might even thrive during these difficult times.

We hope you enjoyed our post: A small business breakdown of the government’s economic stimulus